In the following analysis late October, I had suggested that Silver was topping and would retest the September low.

http://cyclicalmarketanalysis.blogspot.com/2011/10/silver-rounded-top.html

It did test the September low last week, and also found support at the major trendline in white. The bottom is likely in place, and while Silver may start with a gradual rise, it is anticipated to finish in parabolic fashion.

Daily Chart

Gold also hit a major trendline last week going back to 2009. Interestingly, the timing at the bottom lines up exactly with the triangle apex.

A steady rise for Gold makes Gold a better performer early on than Silver, but Silver finishes much stronger with a parabolic move.

The upside for Gold and Silver to the target prices is equal on a percentage basis.

Daily Chart

Saturday, December 31, 2011

Thursday, December 29, 2011

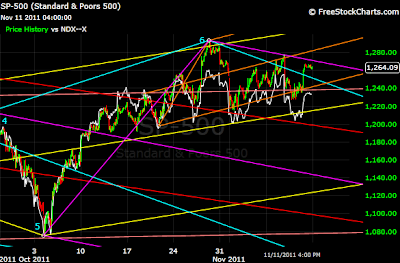

$SPX - Bearish Indications for Tomorrow

SPX hit resistance today at the red fork. The cycle analysis is also extremely negative for tomorrow.

NDX continues to weaken, and the gap is widening. I showed many charts in the first half of 2011 with comparisons using the financials and SPX. The Financials were warning well in advance of the August collapse, and in this case it is NDX.

60min Chart

2hour Chart

The DAX is leading down in December. I have shown the DAX comparison before, and it has given great signals in advance of downturns in SPX.

Daily Chart

NDX continues to weaken, and the gap is widening. I showed many charts in the first half of 2011 with comparisons using the financials and SPX. The Financials were warning well in advance of the August collapse, and in this case it is NDX.

60min Chart

2hour Chart

The DAX is leading down in December. I have shown the DAX comparison before, and it has given great signals in advance of downturns in SPX.

Daily Chart

Tuesday, December 27, 2011

$INDU - Major Decline Next

The white trendline is anticipated to be tested early in 2012. This represents a 20% decline from the current level. The white line is equivalent to the trendline shown in my recent SPX analysis.

There is tremendous resistance overhead with a major decline anticipated to commence shortly.

2day Chart

Timing should be close to the apex marked with the green arrow. Early 2012...

7day Chart

Monthly Chart

There is tremendous resistance overhead with a major decline anticipated to commence shortly.

2day Chart

Timing should be close to the apex marked with the green arrow. Early 2012...

7day Chart

Monthly Chart

Saturday, December 24, 2011

$SPX - Long Term Resistance

The market has been darting up and down with numerous rapid whipsaws and large gaps. The reason for this type of trading is that SPX is "boxed in" at long term resistance.

The chatter amongst traders recently has become increasingly focused on minute details. Sometimes it is helpful to zoom out and see the "lay of the land". The best charts are often simple ones.

A test of the white trendline is the target that has been proposed for early 2012.

The fact that SPX is currently trading at such an important technical level sets up 2012 to be an interesting year to say the least!

7day Chart

The chatter amongst traders recently has become increasingly focused on minute details. Sometimes it is helpful to zoom out and see the "lay of the land". The best charts are often simple ones.

A test of the white trendline is the target that has been proposed for early 2012.

The fact that SPX is currently trading at such an important technical level sets up 2012 to be an interesting year to say the least!

7day Chart

Thursday, December 22, 2011

SPY - Backtest

This may be a backtest of the white trendline going back to the August lows. The reactions to this white line have been quite violent in the past. Originally it was the flag boundary in the summer.

Let's see if the market finds this line important.

2hour Chart

Let's see if the market finds this line important.

2hour Chart

Tuesday, December 20, 2011

$SPX - CRASH December 27th to January 6th

All of the methods that I use including symmetry, geometry, cycles, and cycle analysis are extremely bearish in late December. Not only that, but the market is confirming with leading indexes (such as NDX and DAX) leading down for months already.

The crash is anticipated to start from Dec 27th or 28th, and could reach the 1044 SPX target on January 6th. Steep declines may come on Dec 28th through Dec 30th according to the cycle analysis system.

This summer, I used the same cycle analysis system to pinpoint a selloff into August 10th +/- 1 day, and mentioned this date many times in my July analysis. It is the same system that I am using this time as well.

This should be taken as a firm warning!

60min Chart

The crash is anticipated to start from Dec 27th or 28th, and could reach the 1044 SPX target on January 6th. Steep declines may come on Dec 28th through Dec 30th according to the cycle analysis system.

This summer, I used the same cycle analysis system to pinpoint a selloff into August 10th +/- 1 day, and mentioned this date many times in my July analysis. It is the same system that I am using this time as well.

This should be taken as a firm warning!

60min Chart

Gold/Silver - Bottoming - Massive Upside into early 2012

There appears to be upside by Dec 27th for both Silver (red line target) and Gold. However, the cycle analysis indicates extreme weakness in the S&P starting from Dec 28th to the 30th, and continuing into January 6th. This market-wide weakness likely will also initially manifest in late December in the Gold and Silver markets causing some weakness amid forced liquidations and panic.

So while the recent bottoms for Gold and Silver are likely to be retested, and probably undercut slightly in late December, the charts are super bullish into early 2012 for both metals.

The move higher in January is slower for Silver initially than Gold, but while Gold rises steadily, Silver finishes with a parabolic rise to $37 for the Silver futures!

60min Chart

Gold target is $2,050.00

60min Chart

So while the recent bottoms for Gold and Silver are likely to be retested, and probably undercut slightly in late December, the charts are super bullish into early 2012 for both metals.

The move higher in January is slower for Silver initially than Gold, but while Gold rises steadily, Silver finishes with a parabolic rise to $37 for the Silver futures!

60min Chart

Gold target is $2,050.00

60min Chart

Monday, December 19, 2011

SPY - Rate of Descent - According to Plan

SPY has continued down in a steady decline. The yellow line was drawn on Dec 5th. Notice how SPY has declined at the same angle of descent as the line was drawn in advance. I chose that angle, or rate of descent, because it is half the rate as the two-week decline this summer into the August 9th low.

I suspect that the market may see a bounce soon into Dec 21st. From that date into Dec 23rd looks weak again. Dec 27th looks more positive and then Dec 28th, 29th, and 30th all look very negative in the cycle analysis system.

I suspect that the market flattens off somewhat and manages a few bounces around Christmas. The expectation is for an acceleration down Dec 28th to Dec 30th to maintain the same rate of descent overall.

Daily Chart

NDX has continued to lead down, and is currently trading at approximately 1160 SPX on a performance comparison basis since October.

Once the yellow line breaks, look for an acceleration down.

60min Chart

I suspect that the market may see a bounce soon into Dec 21st. From that date into Dec 23rd looks weak again. Dec 27th looks more positive and then Dec 28th, 29th, and 30th all look very negative in the cycle analysis system.

I suspect that the market flattens off somewhat and manages a few bounces around Christmas. The expectation is for an acceleration down Dec 28th to Dec 30th to maintain the same rate of descent overall.

Daily Chart

NDX has continued to lead down, and is currently trading at approximately 1160 SPX on a performance comparison basis since October.

Once the yellow line breaks, look for an acceleration down.

60min Chart

Thursday, December 15, 2011

$SPX - NDX Still Leading Down

The slide has been steady down from the triple top as anticipated. NDX continues to lead on the downside. The low VIX is an indication of unusually high complacency, and this is a very bearish signal.

A crisis is about to erupt. The charts for Gold and Silver are extremely bullish near term.

Tomorrow looks much weaker than today in my cycle analysis. The target remains 1,044 SPX.

30min Chart

A crisis is about to erupt. The charts for Gold and Silver are extremely bullish near term.

Tomorrow looks much weaker than today in my cycle analysis. The target remains 1,044 SPX.

30min Chart

Wednesday, December 14, 2011

Gold - Ready to Skyrocket!

The safe haven trade in Gold is ready to ignite with an explosive move higher. The symmetry for Gold is outrageously bullish near term. The geometry is favorable for a bottom with very solid support at this level. Minor downside to the white line is possible.

The January target is $2,020.

Daily Chart

The Silver chart is extremely bullish near term. The white trendline held today. A slight undershoot of the line still remains a possibility. The next target is $37.

60min Chart

The January target is $2,020.

Daily Chart

The Silver chart is extremely bullish near term. The white trendline held today. A slight undershoot of the line still remains a possibility. The next target is $37.

60min Chart

Silver - Hit Target - 3rd Bottom

Silver hit the anticipated downside target this morning. The symmetry suggests that the 3rd bottom is a significant bottom with a strong rise to follow.

A rise from point 3 to point 4 should be steady with few dips. A top is anticipated at approximately $37 on the Silver futures (point 6). Point 6 is anticipated to be a higher high than point 4.

2hour Chart

A rise from point 3 to point 4 should be steady with few dips. A top is anticipated at approximately $37 on the Silver futures (point 6). Point 6 is anticipated to be a higher high than point 4.

2hour Chart

Sunday, December 11, 2011

$SPX - DAX Leading Down

Much of the current economic news has centered around the situation in Europe. The German DAX has been a good leading indicator for SPX. The higher low for the DAX in July 2010 was a solid indicator of a bullish move to commence.

The same was true in early October 2011. The higher low on the DAX suggested a bounce. Why just a short lived bounce?

Daily Chart

Unlike 2010, The performance of the DAX is still much weaker than SPX. The large gap in DAX vs SPX is quite clear, and should be taken as a serious warning.

Daily Chart

The same was true in early October 2011. The higher low on the DAX suggested a bounce. Why just a short lived bounce?

Daily Chart

Unlike 2010, The performance of the DAX is still much weaker than SPX. The large gap in DAX vs SPX is quite clear, and should be taken as a serious warning.

Daily Chart

Wednesday, December 7, 2011

$SPX - Triple Top

The orange fork was hit perfectly today completing a nice, clean triple top. Price closed under the yellow midfork, and I anticipate that the downtrend has now commenced.

The "2008 pattern" as well as symmetry indicate a steady grind down. The cycle analysis was positive mid this week, and it weakens dramatically from this time. This is very solid support that the top call from a few days ago holds true.

Traders have been trained now to trade the "November whipsaws". So the market throws it's curve ball. No whipsaws - steady trend down. There are no bounces of any significance on the way down.

The mistake many will make is to try and pick a bottom all the way down. Don't fall into this trap. Sit, relax, and wait for the bottom. Target 1044 SPX.

As shown NDX has already been leading down since Monday.

30min Chart

The "2008 pattern" as well as symmetry indicate a steady grind down. The cycle analysis was positive mid this week, and it weakens dramatically from this time. This is very solid support that the top call from a few days ago holds true.

Traders have been trained now to trade the "November whipsaws". So the market throws it's curve ball. No whipsaws - steady trend down. There are no bounces of any significance on the way down.

The mistake many will make is to try and pick a bottom all the way down. Don't fall into this trap. Sit, relax, and wait for the bottom. Target 1044 SPX.

As shown NDX has already been leading down since Monday.

30min Chart

Monday, December 5, 2011

SPY - Top is IN!

All of the cycles and methods that I use in my analysis are unanimously bearish with a major decline commencing today, and continuing through December. The symmetry indicates that the decline will be steady, relentless with no significant bounces until 1044 SPX.

A substantial bounce is expected from the 1044 SPX January 2012 target. A final low is estimated at 1025 SPX early 2012. The entire process is mapped out in the symmetry to be an inverse Head and Shoulders pattern encompassing several months early 2012. The target at the green arrow is the Left Shoulder.

This is a market trending downwards. There have been lower highs since late October, and in fact, lower highs since May.

The coloured arrows correlate to my "2008" pattern. Further charts will be coming shortly.

Daily Chart

A substantial bounce is expected from the 1044 SPX January 2012 target. A final low is estimated at 1025 SPX early 2012. The entire process is mapped out in the symmetry to be an inverse Head and Shoulders pattern encompassing several months early 2012. The target at the green arrow is the Left Shoulder.

This is a market trending downwards. There have been lower highs since late October, and in fact, lower highs since May.

The coloured arrows correlate to my "2008" pattern. Further charts will be coming shortly.

Daily Chart

Saturday, December 3, 2011

$SPX and Silver - Updated

SPX traded into the oval target range last week, and a decline appears imminent. The green arrow marks a possible downside target on a short term basis.

After this decline a solid bounce looks probable into the middle of next week.

However, my outlook as previously outlined is exceptionally bearish with a 20% decline forecast into January from the current level.

10min Chart

Silver has taken longer to set up properly, and that means the timing is pushed out. A third bottom would have me taking a bullish stance on Silver as per the Symmetry.

Silver futures could bottom around $29.50, and then a steady grind higher in December is anticipated up to $37 in January.

30min Chart

After this decline a solid bounce looks probable into the middle of next week.

However, my outlook as previously outlined is exceptionally bearish with a 20% decline forecast into January from the current level.

10min Chart

Silver has taken longer to set up properly, and that means the timing is pushed out. A third bottom would have me taking a bullish stance on Silver as per the Symmetry.

Silver futures could bottom around $29.50, and then a steady grind higher in December is anticipated up to $37 in January.

30min Chart

Wednesday, November 30, 2011

$SPX - Exceptionally Bearish Now

SPX has bounced sharply into the targeted zone outlined last week - ahead of schedule. As shown, there are ample resistances at this level, and SPX is anticipated to top out as a result. Price hit the white trendline, and a decline is expected tomorrow/Friday. Perhaps a test of the turquoise line is in order, with a bounce into around Dec 6-7th appearing in my cycle analysis. Because the price is already at the targeted zone, early next week may just put in a lower high.

After Dec 6-7th, my work for December is exceptionally bearish. The next target is 1020 (point 7 in my symmetrical pattern. That would be a 20% decline from current levels, and that is anticipated to be hit in January.

From my patterns, the decline should be steady, relentless, with few bounces until 1040. I have additional charts coming to show further detail on this move.

NDX is leading down, and that has been the case since mid-October. This is a formerly leading index, and it is struggling to bounce.

60min Chart

Silver has seen a decent bounce this week. However, according to the symmetry chart shown previously, a lower low is favored. Once point 3 completes at estimated $30 on the Silver futures, then finally solid upside to $36.50 area on the futures is anticipated.

Minor upside from today's close is possible for Silver, but it still looks probable that we can finally see this lower low in the next couple days.

30min Chart

After Dec 6-7th, my work for December is exceptionally bearish. The next target is 1020 (point 7 in my symmetrical pattern. That would be a 20% decline from current levels, and that is anticipated to be hit in January.

From my patterns, the decline should be steady, relentless, with few bounces until 1040. I have additional charts coming to show further detail on this move.

NDX is leading down, and that has been the case since mid-October. This is a formerly leading index, and it is struggling to bounce.

60min Chart

Silver has seen a decent bounce this week. However, according to the symmetry chart shown previously, a lower low is favored. Once point 3 completes at estimated $30 on the Silver futures, then finally solid upside to $36.50 area on the futures is anticipated.

Minor upside from today's close is possible for Silver, but it still looks probable that we can finally see this lower low in the next couple days.

30min Chart

Monday, November 28, 2011

Gold - Target $2,000

Gold appears to be forming a triangle. Once the current consolidation period completes, a surge up to just over $2,000 is anticipated.

60min Chart

60min Chart

Friday, November 25, 2011

Silver - Third Time is the Charm!

For Silver there have been 2 false starts up off the bottom. A third and final bottom should be the "real" bottom according to the symmetry. Should be interesting Monday morning.

Next week looks bullish for Silver. The move up from point 3 to point 4 should be strong with few dips.

60min Chart

Next week looks bullish for Silver. The move up from point 3 to point 4 should be strong with few dips.

60min Chart

Thursday, November 24, 2011

$SPX - Short Term Bottom

SPX hit the orange midfork and the white trendline. I am confident that this level holds as a short term bottom. Next, a significant bounce is expected to minimum 1240 into December 6th.

The symmetry did follow through with a move down from point 6. Price is on the way to point 7 which is anticipated to be substantially lower than the early October low (point 5). Watch out for the short squeeze into Dec 6th though.

Notice that this pattern is not a mirror image, but this is a typical example of symmetry. Point 6 on the left side was very choppy, and that was why I was expecting whipsaws early in November during point 6 on the right side.

2hour Chart

The symmetry did follow through with a move down from point 6. Price is on the way to point 7 which is anticipated to be substantially lower than the early October low (point 5). Watch out for the short squeeze into Dec 6th though.

Notice that this pattern is not a mirror image, but this is a typical example of symmetry. Point 6 on the left side was very choppy, and that was why I was expecting whipsaws early in November during point 6 on the right side.

2hour Chart

Tuesday, November 22, 2011

$SPX - Final Whipsaw

SPX had been bouncing on the yellow midfork since mid-October. Finally it broke down below, and met the time target of Nov 21st and price target of 1187. The red fork line has been holding back a rally, but a break out above is expected soon.

A solid bounce is anticipated next into Dec 6th. The price target may be approximately 1260 which would also be a backtest of the yellow midfork. It should bounce this week as the cycle analysis is bullish. Next week is mixed and may indicate chop eventually rallying up into the time target.

30min Chart

The Silver chart is quite bullish short term. A bounce is anticipated to near $36.50 on the Silver future. Don't overstay....

30min Chart

A solid bounce is anticipated next into Dec 6th. The price target may be approximately 1260 which would also be a backtest of the yellow midfork. It should bounce this week as the cycle analysis is bullish. Next week is mixed and may indicate chop eventually rallying up into the time target.

30min Chart

The Silver chart is quite bullish short term. A bounce is anticipated to near $36.50 on the Silver future. Don't overstay....

30min Chart

Sunday, November 20, 2011

SPY - 2008 Pattern Continues

There continues to be similarity in the trading pattern of 2011 compared to 2008. The next leg down to the green arrow is expected to commence soon. The November whipsaws are nearing completion.

December in particular looks very bearish.

As shown though the end result is anticipated to look much different in 2012 than it did in 2008. Instead of a crash, a massive rally kicks off from the green arrow. Despite the economic malaise, 2012 looks extremely bullish!

Make no mistake, eventually the markets will reflect the deteriorating economic conditions, and my cycle work predicts how and when this will occur.

The 2008 comparison is a convenient way to show what is anticipated next. The main evidence comes from my other cycle work. For example, the symmetry charts indicate another plunge, the cycle analysis looks bearish, and other methods are in agreement. I will outline more specific thoughts as to the important dates, and smaller time frame patterns later.

Some downside early next week is possible, but a solid bounce is anticipated next week before the more bearish cycles start to become active.

Daily Chart

This is the pattern from the 2008 crash:

3day Chart

December in particular looks very bearish.

As shown though the end result is anticipated to look much different in 2012 than it did in 2008. Instead of a crash, a massive rally kicks off from the green arrow. Despite the economic malaise, 2012 looks extremely bullish!

Make no mistake, eventually the markets will reflect the deteriorating economic conditions, and my cycle work predicts how and when this will occur.

The 2008 comparison is a convenient way to show what is anticipated next. The main evidence comes from my other cycle work. For example, the symmetry charts indicate another plunge, the cycle analysis looks bearish, and other methods are in agreement. I will outline more specific thoughts as to the important dates, and smaller time frame patterns later.

Some downside early next week is possible, but a solid bounce is anticipated next week before the more bearish cycles start to become active.

Daily Chart

This is the pattern from the 2008 crash:

3day Chart

Thursday, November 17, 2011

Silver - Volatile Again

The quiet sideways period is over and volatility is increasing in Silver again. The rounded top formed as expected. Today the midfork was tested and that should act as support on a short term basis.

Next, a rebound up is anticipated. Stops can be placed under the midfork.

A plunge to test the September low is anticipated to follow in December.

60min Chart

Next, a rebound up is anticipated. Stops can be placed under the midfork.

A plunge to test the September low is anticipated to follow in December.

60min Chart

Sunday, November 13, 2011

$SPX - Week Ahead

As anticipated there has been strength into Nov 14th. Much of my work suggests a high around Nov 17th, and then decline into Nov 21st. The theme continues to be the same - November whipsaws.

15min Chart

Since late October, NDX has been weakening relative to SPX.

30min Chart

15min Chart

Since late October, NDX has been weakening relative to SPX.

30min Chart

Wednesday, November 9, 2011

$SPX - Tested Midfork

The orange midfork was tested. Today is the weakest day of the week in my cycle analysis. The market is still in a sideways whipsaw zone this month from what I see. Around Nov 14th looks very positive so a pullback should be limited to this week.

I have a plan for December, and will outline that soon, but it is better not to get too far ahead of the market.

15min Chart

I have a plan for December, and will outline that soon, but it is better not to get too far ahead of the market.

15min Chart

Sunday, November 6, 2011

Silver - Update

Silver did spike down, back up, and now should be entering the "Rounded Top" zone. Probably the price trends sideways in a relatively tight range.

Once the Rounded Top completes, then a test of near the late September low is anticipated to follow. I'll have more to say on timing at a later date.

30min Chart

Once the Rounded Top completes, then a test of near the late September low is anticipated to follow. I'll have more to say on timing at a later date.

30min Chart

SPX continues to trade sideways with whipsaws. There will be more detailed analysis soon with dates to watch, and reasoning for the next significant moves approaching.

30min Chart

Tuesday, November 1, 2011

$SPX - Update

As expected there was heavy selling pressure Oct 31st and Nov 1st. SPX found support today at the red trendline. There may still be some minimal downside, but the timing cycle for the low is due, and the latter part of this week looks quite positive.

A test of 1280's later this week is anticipated. After that the next low in my cycle work is around Nov 8-9th.

30min Chart

A test of 1280's later this week is anticipated. After that the next low in my cycle work is around Nov 8-9th.

30min Chart

Sunday, October 30, 2011

Silver - Rounded Top

For Silver a dip to test near the midfork this week is the plan. A rounded top in a tight sideways range should follow after that dip. Once the rounded top is complete, a decline to test the September low is anticipated.

60min Chart

Thursday, October 27, 2011

$SPX - Next Week

A top is probably in, or very close. Looking at the geometry, a decline to the green arrow seems possible into next week. That is approximately 1187 SPX.

In terms of timing, around Oct 31st to Nov 1st looks bearish in cycles, but starting around Nov 3rd looks surprisingly bullish from my work. Looking at the symmetry at point 6 (yellow) a dip down occurs after the top (from Right to Left). I think it may occur similarly this time as well.

Next week looks very volatile, and it is going to be important in terms of confirmation in my cycle theory.

60min Chart

Silver hit the orange line target today. Price and timing targets both were very accurate on this chart (link below). Upside looks minimal from here, and a quick dip to $30 or so looks possible into next week.

http://cyclicalmarketanalysis.blogspot.com/2011/09/silver-collapse-resumes-2012-target-650.html

2hour Chart

In terms of timing, around Oct 31st to Nov 1st looks bearish in cycles, but starting around Nov 3rd looks surprisingly bullish from my work. Looking at the symmetry at point 6 (yellow) a dip down occurs after the top (from Right to Left). I think it may occur similarly this time as well.

Next week looks very volatile, and it is going to be important in terms of confirmation in my cycle theory.

60min Chart

Silver hit the orange line target today. Price and timing targets both were very accurate on this chart (link below). Upside looks minimal from here, and a quick dip to $30 or so looks possible into next week.

http://cyclicalmarketanalysis.blogspot.com/2011/09/silver-collapse-resumes-2012-target-650.html

2hour Chart

Wednesday, October 26, 2011

$SPX - Bounced on Support

Bounced as suggested this morning with the fork lines doing a nice job of defining support levels:

"Wasn't surprising to see the bounce this morning since closed yesterday at some support. Now trading at the red line. Financials haven't followed through as much on the downside this morning. Looks like a short term bounce may set up again soon."

NDX is still underperforming though, and that is an issue in terms of sustainability of this rally. As well I have Oct 31st and Nov 1st flagged for potential weakness.

15min Chart

"Wasn't surprising to see the bounce this morning since closed yesterday at some support. Now trading at the red line. Financials haven't followed through as much on the downside this morning. Looks like a short term bounce may set up again soon."

NDX is still underperforming though, and that is an issue in terms of sustainability of this rally. As well I have Oct 31st and Nov 1st flagged for potential weakness.

15min Chart

Tuesday, October 25, 2011

$SPX - 30min Chart

Short term support and resistance lines are shown on this chart. The rally hit resistance at the orange fork and retreated hitting some support at the end of the day today.

My cycle work indicates some selling should occur into Oct 31st or Nov 1st. Around Nov 3rd looks quite positive though.

I've shown some larger scale charts previously, and will take it one step at a time as well with the short term charts into the next turn date.

30min Chart

My cycle work indicates some selling should occur into Oct 31st or Nov 1st. Around Nov 3rd looks quite positive though.

I've shown some larger scale charts previously, and will take it one step at a time as well with the short term charts into the next turn date.

30min Chart

Sunday, October 23, 2011

SPY - 2011 Pattern Similar to 2008

There is a comparison to 2008 that can be made with the pattern of trading so far in 2011. Despite the similarily, I do not see evidence that a 2008 style of crash is about to occur. The market has a mechanism of alternating patterns which look similar on the surface for a while, but produce a much different end result.

For example, many will remember the May-July 2009 Head and Shoulders failed pattern. Traders questioned the Head and Shoulders top during February to July this year, but unlike 2009, the bearish 2011 H&S pattern did complete and follow through this time in 2011.

This is 2011, not 2008, and the similarity can be useful for a period of time, but ultimately each should be treated as a unique situation.

While the current trading pattern in 2011 mimics 2008, the difference this time shows up in the cycles, and it shows in the sentiments. I remember 2008 clearly, and there were not many bears in the summer of 2008. Since summer 2011, bearish sentiments have built up quite high.

The 2008 pattern also reminds that bear market rallies can be deceptively sharp.

Daily

The following is the 2008 Crash.

3day Chart

For example, many will remember the May-July 2009 Head and Shoulders failed pattern. Traders questioned the Head and Shoulders top during February to July this year, but unlike 2009, the bearish 2011 H&S pattern did complete and follow through this time in 2011.

This is 2011, not 2008, and the similarity can be useful for a period of time, but ultimately each should be treated as a unique situation.

While the current trading pattern in 2011 mimics 2008, the difference this time shows up in the cycles, and it shows in the sentiments. I remember 2008 clearly, and there were not many bears in the summer of 2008. Since summer 2011, bearish sentiments have built up quite high.

The 2008 pattern also reminds that bear market rallies can be deceptively sharp.

Daily

The following is the 2008 Crash.

3day Chart

Thursday, October 20, 2011

$SPX - 10min Chart

SPX bounced again today at the yellow midfork line which has proven to be important. Trading is in a sideways pattern, but I expect we'll see further confirmation soon.

10min Chart

10min Chart

Subscribe to:

Comments (Atom)