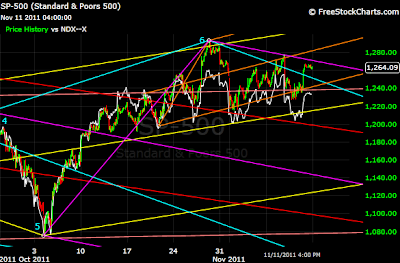

SPX has bounced sharply into the targeted zone outlined last week - ahead of schedule. As shown, there are ample resistances at this level, and SPX is anticipated to top out as a result. Price hit the white trendline, and a decline is expected tomorrow/Friday. Perhaps a test of the turquoise line is in order, with a bounce into around Dec 6-7th appearing in my cycle analysis. Because the price is already at the targeted zone, early next week may just put in a lower high.

After Dec 6-7th, my work for December is exceptionally bearish. The next target is 1020 (point 7 in my symmetrical pattern. That would be a 20% decline from current levels, and that is anticipated to be hit in January.

From my patterns, the decline should be steady, relentless, with few bounces until 1040. I have additional charts coming to show further detail on this move.

NDX is leading down, and that has been the case since mid-October. This is a formerly leading index, and it is struggling to bounce.

60min Chart

Silver has seen a decent bounce this week. However, according to the symmetry chart shown previously, a lower low is favored. Once point 3 completes at estimated $30 on the Silver futures, then finally solid upside to $36.50 area on the futures is anticipated.

Minor upside from today's close is possible for Silver, but it still looks probable that we can finally see this lower low in the next couple days.

30min Chart

Wednesday, November 30, 2011

Monday, November 28, 2011

Gold - Target $2,000

Gold appears to be forming a triangle. Once the current consolidation period completes, a surge up to just over $2,000 is anticipated.

60min Chart

60min Chart

Friday, November 25, 2011

Silver - Third Time is the Charm!

For Silver there have been 2 false starts up off the bottom. A third and final bottom should be the "real" bottom according to the symmetry. Should be interesting Monday morning.

Next week looks bullish for Silver. The move up from point 3 to point 4 should be strong with few dips.

60min Chart

Next week looks bullish for Silver. The move up from point 3 to point 4 should be strong with few dips.

60min Chart

Thursday, November 24, 2011

$SPX - Short Term Bottom

SPX hit the orange midfork and the white trendline. I am confident that this level holds as a short term bottom. Next, a significant bounce is expected to minimum 1240 into December 6th.

The symmetry did follow through with a move down from point 6. Price is on the way to point 7 which is anticipated to be substantially lower than the early October low (point 5). Watch out for the short squeeze into Dec 6th though.

Notice that this pattern is not a mirror image, but this is a typical example of symmetry. Point 6 on the left side was very choppy, and that was why I was expecting whipsaws early in November during point 6 on the right side.

2hour Chart

The symmetry did follow through with a move down from point 6. Price is on the way to point 7 which is anticipated to be substantially lower than the early October low (point 5). Watch out for the short squeeze into Dec 6th though.

Notice that this pattern is not a mirror image, but this is a typical example of symmetry. Point 6 on the left side was very choppy, and that was why I was expecting whipsaws early in November during point 6 on the right side.

2hour Chart

Tuesday, November 22, 2011

$SPX - Final Whipsaw

SPX had been bouncing on the yellow midfork since mid-October. Finally it broke down below, and met the time target of Nov 21st and price target of 1187. The red fork line has been holding back a rally, but a break out above is expected soon.

A solid bounce is anticipated next into Dec 6th. The price target may be approximately 1260 which would also be a backtest of the yellow midfork. It should bounce this week as the cycle analysis is bullish. Next week is mixed and may indicate chop eventually rallying up into the time target.

30min Chart

The Silver chart is quite bullish short term. A bounce is anticipated to near $36.50 on the Silver future. Don't overstay....

30min Chart

A solid bounce is anticipated next into Dec 6th. The price target may be approximately 1260 which would also be a backtest of the yellow midfork. It should bounce this week as the cycle analysis is bullish. Next week is mixed and may indicate chop eventually rallying up into the time target.

30min Chart

The Silver chart is quite bullish short term. A bounce is anticipated to near $36.50 on the Silver future. Don't overstay....

30min Chart

Sunday, November 20, 2011

SPY - 2008 Pattern Continues

There continues to be similarity in the trading pattern of 2011 compared to 2008. The next leg down to the green arrow is expected to commence soon. The November whipsaws are nearing completion.

December in particular looks very bearish.

As shown though the end result is anticipated to look much different in 2012 than it did in 2008. Instead of a crash, a massive rally kicks off from the green arrow. Despite the economic malaise, 2012 looks extremely bullish!

Make no mistake, eventually the markets will reflect the deteriorating economic conditions, and my cycle work predicts how and when this will occur.

The 2008 comparison is a convenient way to show what is anticipated next. The main evidence comes from my other cycle work. For example, the symmetry charts indicate another plunge, the cycle analysis looks bearish, and other methods are in agreement. I will outline more specific thoughts as to the important dates, and smaller time frame patterns later.

Some downside early next week is possible, but a solid bounce is anticipated next week before the more bearish cycles start to become active.

Daily Chart

This is the pattern from the 2008 crash:

3day Chart

December in particular looks very bearish.

As shown though the end result is anticipated to look much different in 2012 than it did in 2008. Instead of a crash, a massive rally kicks off from the green arrow. Despite the economic malaise, 2012 looks extremely bullish!

Make no mistake, eventually the markets will reflect the deteriorating economic conditions, and my cycle work predicts how and when this will occur.

The 2008 comparison is a convenient way to show what is anticipated next. The main evidence comes from my other cycle work. For example, the symmetry charts indicate another plunge, the cycle analysis looks bearish, and other methods are in agreement. I will outline more specific thoughts as to the important dates, and smaller time frame patterns later.

Some downside early next week is possible, but a solid bounce is anticipated next week before the more bearish cycles start to become active.

Daily Chart

This is the pattern from the 2008 crash:

3day Chart

Thursday, November 17, 2011

Silver - Volatile Again

The quiet sideways period is over and volatility is increasing in Silver again. The rounded top formed as expected. Today the midfork was tested and that should act as support on a short term basis.

Next, a rebound up is anticipated. Stops can be placed under the midfork.

A plunge to test the September low is anticipated to follow in December.

60min Chart

Next, a rebound up is anticipated. Stops can be placed under the midfork.

A plunge to test the September low is anticipated to follow in December.

60min Chart

Sunday, November 13, 2011

$SPX - Week Ahead

As anticipated there has been strength into Nov 14th. Much of my work suggests a high around Nov 17th, and then decline into Nov 21st. The theme continues to be the same - November whipsaws.

15min Chart

Since late October, NDX has been weakening relative to SPX.

30min Chart

15min Chart

Since late October, NDX has been weakening relative to SPX.

30min Chart

Wednesday, November 9, 2011

$SPX - Tested Midfork

The orange midfork was tested. Today is the weakest day of the week in my cycle analysis. The market is still in a sideways whipsaw zone this month from what I see. Around Nov 14th looks very positive so a pullback should be limited to this week.

I have a plan for December, and will outline that soon, but it is better not to get too far ahead of the market.

15min Chart

I have a plan for December, and will outline that soon, but it is better not to get too far ahead of the market.

15min Chart

Sunday, November 6, 2011

Silver - Update

Silver did spike down, back up, and now should be entering the "Rounded Top" zone. Probably the price trends sideways in a relatively tight range.

Once the Rounded Top completes, then a test of near the late September low is anticipated to follow. I'll have more to say on timing at a later date.

30min Chart

Once the Rounded Top completes, then a test of near the late September low is anticipated to follow. I'll have more to say on timing at a later date.

30min Chart

SPX continues to trade sideways with whipsaws. There will be more detailed analysis soon with dates to watch, and reasoning for the next significant moves approaching.

30min Chart

Tuesday, November 1, 2011

$SPX - Update

As expected there was heavy selling pressure Oct 31st and Nov 1st. SPX found support today at the red trendline. There may still be some minimal downside, but the timing cycle for the low is due, and the latter part of this week looks quite positive.

A test of 1280's later this week is anticipated. After that the next low in my cycle work is around Nov 8-9th.

30min Chart

A test of 1280's later this week is anticipated. After that the next low in my cycle work is around Nov 8-9th.

30min Chart

Subscribe to:

Posts (Atom)