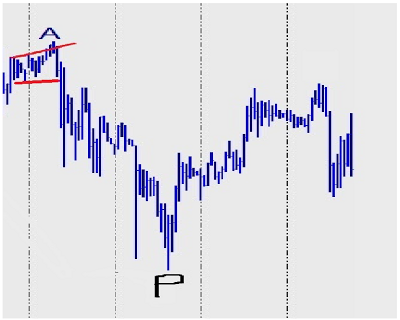

SPX spiked up, and appears to be forming an ascending broadening wedge according to the Cycle model. Currently SPX is likely forming a high.

Support is located at the lower red line. Therefore, SPX should work it's way down to test the lower red support line with time.

Daily Chart

SPX Deja Vu Cycle:

The Cycle model explains why SPX made the recent surge up.

ReplyDeleteAccording to the model, it's a "fake" breakout, and should settle back to around 2,040 SPX.

There is time for a pre-election selloff, and then another rally should commence in the fall!

ReplyDelete

ReplyDeleteSc, cpc at .42, investor intelligence 54%bullish, msn green/fear: 90%bulls, do you think with 200 point drop will bring enough fear to take it to 2250

SC, so you see close on the high today, then big drop tomorrow?

ReplyDeleteI'm not sure which day it'll drop, but I do think SPX is forming a high.

DeleteWhen is P supposed to happen again? 2020?

ReplyDeleteSomething like that.

DeletePoint A looks like it'll occur around the end of this year.

BIG DROP COMING INTO FRIDAY MONDAY

ReplyDeleteTarget?

DeleteSMH

ReplyDeleteSo p has happenef. Now u expect drop to 2040 in aug. Then to 2250 in set oct

ReplyDeleteI dont think P has happened yet...sp says *YEAR 2020* .....not SPX 2020 level... Bit confusing i know

ReplyDeleteLousi hope you correct about SPX drop. Been loading up UVXY $7....pop to $10-11 would be nice

ReplyDeletemight only get 850 9

Delete20% good enough for me

DeleteSc I am confused, r we going to form A now at 2250 or where are we on this chart

ReplyDelete2,040 SPX first to test the lower red line, then around 2,350 SPX Point A.

DeleteTime frame for 2040?

DeleteIt really depends on how it bounces on the way down. I'm confident it'll get there though it could take some time.

DeleteI think the market will be weaker in August than in July. So realistically it could take a month or more.

Why is everyone thinking after taking 2 years to breakout of a range the market makers want to take it down under it?

ReplyDeleteMakes no cents....

That's a good point, and also why the bears should not have high expectations for July. It's a classic short squeeze. With some time the shorts will be squeezed out and the market should fall.

DeleteTherefore, some wobbles in July, but August looks better for the bears than July.

Definitely not saying spx drop couldn't happen but odds are becoming with the bulls on breakout of that range.

DeleteAugust is a much better volatility month than July....

SC, so the low volume wedge keeps going on with tons of gaps below, msn bear bull at 90%

ReplyDeleteWouldn't it make more sense to see a wedge for this 5th wave up, consisting of an abcde pattern instead of a clean 1-5 up?

ReplyDeleteBased on the weekly chart, c up is close to finishing 2170-2200 and then we should expect wave d down, 2100/2080/2050.

Also, the current pattern looks a lot like the pattern we saw in oct 14-may 15.

I think bears will take control next week (or two).

http://tripstrading.com/2016/0...

2139-46 bottom on consolidation to work off overbought.

ReplyDelete2040, absolutely not! We are going up, melt, melt. 2170s, not crazy to sell some. 2174 to start.

Sc msn fear greed at 90. Cpc .50. Do u think correction to 2040 will be enoghy to bring bullish sentiment down for next leg up.

ReplyDeleteWith the controversial election coming sentiment will sour drastically.

Deletegoing down to 2130 and up to 2200

ReplyDeletemaybe 2145 then up to 2210 we will see

ReplyDeleteLouis, no judgement, just a neutral question...what are your targets based on? To me, it still looks like the period Oct 14-May 15, a 5th wave up in the form of a wedge. If this period, Feb 16-now, is a copy and the algos play the same game, then currently it would imply wave c up, 2170 area, and then down into wave d for target 2130, 2100, 2080 and maybe even 2060 (not very likely in my view, just an opinion, worth nothing)...and then wave e up into end of year, 2200+ that's my view. Corrective waves come as a suprise, they do not want anyone in on the right side. So I'm patient...am short, buyt will buy the dips to 2130-2100. Best of luck!

ReplyDeleteIt was a 16 trade date low do today however if we do not pull back to 2145 we're going to go up to 2200 next week will close to that or maybe over that I am not sure the Market s have been weird not doing what it's supposed to do I believe the market goes up to 2190 to 2210 and that area next week

DeleteSPX has continued to show weakness since the turn date on July 15th. Next turn date and low is coming due July 22. After that July 28 interesting for a high.

ReplyDeleteJuly 28 to Aug 10th is a good window for a decline.

ReplyDeleteSPX probably recovers today, but can test 2,150 by July 22.

ReplyDeleteDo you mean 2050, because 2150 is only 12 points drop from here?

Delete2150, it's a quiet market currently. After July 28 looks weaker.

DeleteWhere do you see SPX by July 28?

DeleteJuly 28 could see a higher high. 2180.

DeleteIt is clear that we're forming a high in the model. It'll probably be a rounded top, and it'll take time to form. There probably is minor upside for SPX, but the next major move is a drop to 2,040. It'll happen.

ReplyDeleteVolatility is going to increase as the election approaches.

Remember this is a big picture Cycle model. Each move takes months.

The bears were spoiled with the brexit, but it's unlikely to reoccur so soon. Still, there are going to be surprise drops over the next 3 months.

ReplyDeleteso in next 3 months where do you see spx

ReplyDeleteSPX 2,040.

Deletebut I thought that you expected on aug 10

ReplyDeleteWhen it reaches 2,040 depends on how it bounces on the way down. I expect a significant drop into that date, but it'll take longer to reach to target area given how slow this market is moving.

DeleteAnyway right now we're in the process of working on a high in the model. So one step a time.

Expecting drops August, Sept, Oct....all before the election. 10-15% at least

ReplyDeleteSPX:VIX ratio @ all time high 180.... Warning

ReplyDeletewhere do yo track that

DeletePay day with fear greed index at 90. Do u think 10 per correction will be enough to bring to fear levels

ReplyDelete